That old adage about things looking too good to be true applies to the Transportation Lockbox Constitutional Amendment. At first glance, the opportunity to assure more transportation funds to repair Illinois’ crumbling infrastructure was just that! Closer examination reveals a number of deficiencies.

Ordinarily constitutional amendments emerge out of a broad civic discussion where their impacts can be evaluated from many perspectives and the wording revised to achieve the intended objective. Not this amendment. It was developed behind closed doors and released fully developed – along with an advertising campaign. Indeed, it could be called a “stealth amendment.” Clearly, this amendment has strong interest groups behind it.

CNT has some history dealing with Constitutional provisions with special interests. In the 1980s, CNT was very concerned that landlords could avoid paying property taxes, but make money on to their property for as long as a decade, a practice enshrined in the Illinois Constitution. It took two state-wide campaigns to amend the Constitution to change the Tax Scavenger Sale system and force landlords to either pay their property taxes or lose their property. This painful experience has trained us to look carefully at attempts to embed special rights in the Illinois Constitution.

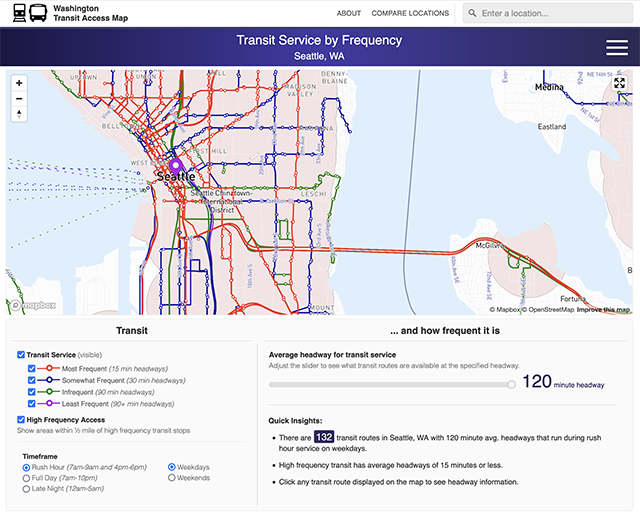

CNT also fought for many years to reform transportation and land use planning processes in Northeastern Illinois. The Chicago Metropolitan Agency for Planning (CMAP) is the result. It is not clear if funding of CMAP from state transportation sources would be allowed if this amendment is approved. It is also uncertain if modes other than highways such as transit, biking and pedestrian access could be funded with “transportation” dollars. As environmentalists, CNT is equally concerned about externalities from burning of fossil fuels. Currently, some of the funds that would be secured in the lockbox support essential research conducted by the Department of Natural Resources (DNR) on alternative energy.

There is no doubt funds paid by the driving public should be used for transportation infrastructure, but for all modes. After all, drivers benefit by the traveling public using alternative modes. All the more reason that taxes paid by drivers should be used to support those modes. Moreover what constitutes a “transportation” investment is changing rapidly.

And there is the future. When the Illinois Constitution was approved, there were no such devices as cell phones, electric or autonomous cars, nor even Segways. How can we, in the first quarter of the 21st century, anticipate the transportation modes over the horizon? It is uncertain if this amendment would allow for funding support.

It would have been preferable if sponsors and supporters of securing a larger percentage of transportation taxes being used for transportation infrastructure had supported a process of public engagement that would have allowed for these and many other questions and concerns being addressed. Instead, what we have as a result is the conclusion: if it looks too good to be true, it probably is. We encourage voters to reject the proposed Transportation Amendment.

Strengthening Transit Through Community Partnerships

Strengthening Transit Through Community Partnerships